8915-e tax form instructions

On the top of the form enter your name and Social Security number. CCH ProSystem fx Tax Forms.

Coronavirus Related Distributions Via Form 8915

Start completing the fillable fields and carefully.

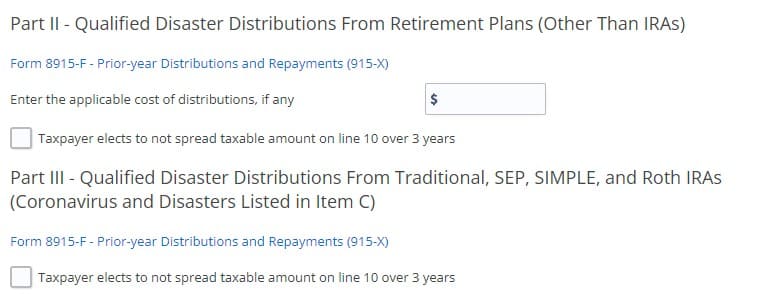

. Click on the product number in each row to. Under this line complete the form fields listing your physical address. The 8915-F is a new form starting in tax year 2021 for Qualified Disaster Retirement Plan Distributions and Repayments.

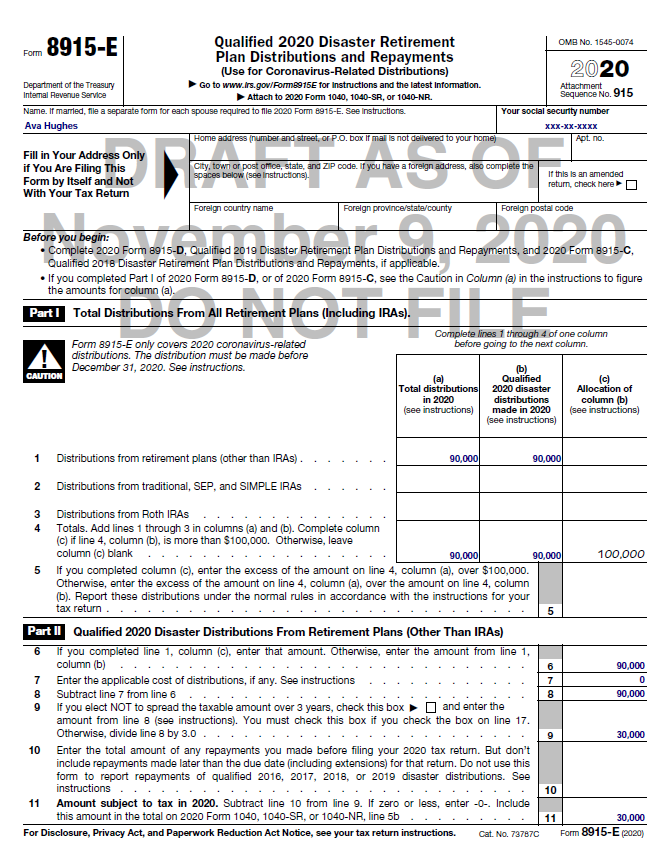

Form 8915-E 2020 Qualified 2020 Disaster Retirement Plan Distributions and Repayments Department of the Treasury Internal Revenue Service Use for Coronavirus-Related and Other. Form 8915E Page 1. Enter the amount from your Form 8915-E line 4 column b and select Continue.

Use Get Form or simply click on the template preview to open it in the editor. Form 8915-E is used by taxpayers who were adversely. This is required per.

In tax year 2021 the 8915-E is a worksheet will show the distribution and track the information to generate the 8915-F. On the top of the form enter your name and Social Security number. Need instructions for Form 8915-E.

The IRS has issued new Form 8915-E which individual taxpayers must file with their income tax returns to report coronavirus-related. Select to complete Qualified 2020 Disaster Distribution from Traditional SEP SIMPLE and Roth IRAs. Need instructions for Form 8915-E.

This form is necessary to report COVID related distributions from IRAs and other retirement plans to report the distribution pay it back over 3 years or spread the tax over 3. Quick steps to complete and design Instructions 8915 Form online. In view mode review the return for accuracy then click the Attach PDF button to automatically attach the Form 8915-E to the e-filed return and clear EF message 2091.

See the instructions for Form 8606 line 15b. Enter on line 1b the amount on 2020 Form 8915-E line 4 column c if you completed that line otherwise from the amount on 2020 Form 8915-E line 4 column b that. The 8915-E is for entering and tracking coronavirus.

Download or print the 2021 Federal Form 8915-E Qualified Hurricane Retirement Plan Distributions and Repayments for FREE from the Federal Internal Revenue Service. 1314Enter the amount if any from 2020 Form 8606 line 25b. Login to your TurboTax Account Click on the Search box on the top and type 1099-R Click on.

The form 8915-e TurboTax was only for the tax year 2020. Once the Form 8915-E is live please follow these steps to enter your 1099-R. But if you are entering amounts here and on2020 Form 8915-D line 23 or Form.

Form 1 Boxes 40 through 43 and Boxes 45 through 48 based on Form M-25 Box 30 or Form. Select a category column heading in the drop down. Enter a term in the Find Box.

Under this line complete the form fields listing your physical address. For instructions on how to complete Form 8915-E in the ProWeb program please click the PDF at the bottom of this page.

Irs Issues Guidance On Cares Act Retirement Plan Relief Sgr Law

Irs Issues Form 8915 F For Reporting Qualified Disaster Distributions And Repayments Provides 2021 Forms For Earlier Disasters

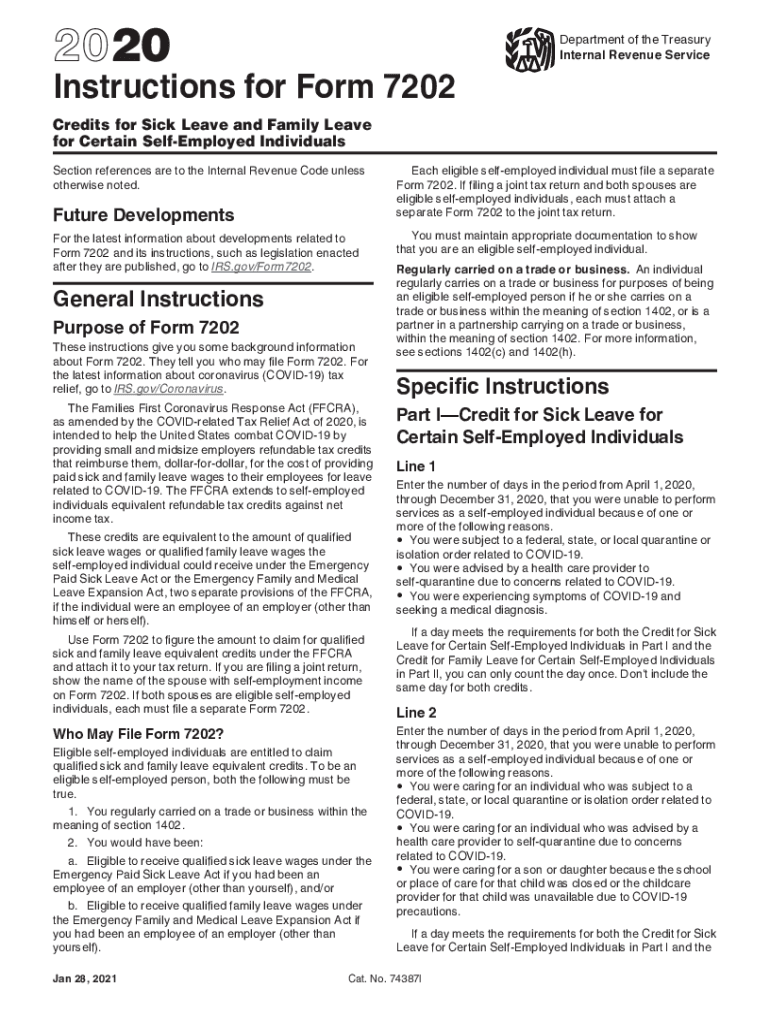

Instructions 7202 Fill Out Sign Online Dochub

Disaster Assistance And Emergency Relief For Individuals And Businesses Internal Revenue Service

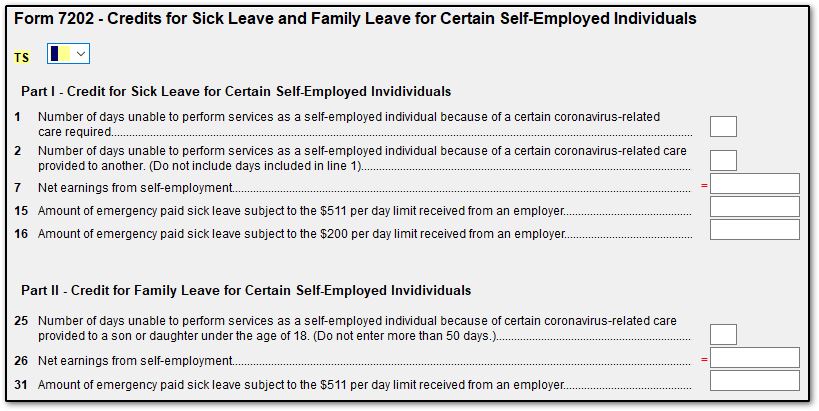

Form 7202 Covid 19 Credit For Sick Leave Or Family Leave Drake20

M O Cpe The Definitive Tax Seminar

Is Turbotax Going To Support A Cares Act Withdrawal From A 401k

Form 8915 E For Retirement Plans H R Block

Fillable Online Form 8898 Rev October 2020 Statement For Individuals Who Begin Or End Bona Fide Residence In A U S Possession Fax Email Print Pdffiller

Tax Form Focus Irs Form 1099 R Strata Trust Company

1040 Forms 8915 A 8915 B 8915 C 8915 D And 8915 E 1099r Fill Out And Sign Printable Pdf Template Signnow

How To Pay Taxes Over 3 Years On Cares Act Distributions Tax Form 8915 E Explained Youtube

Disaster Assistance And Emergency Relief For Individuals And Businesses Internal Revenue Service

Solved I Don T See Turbotax Adjusting For Covid 401 K Withdrawals

:max_bytes(150000):strip_icc()/ScreenShot2021-12-15at3.19.44PM-291c5fe0726d489fb990ff40378b295f.png)

Form 5329 Additional Taxes On Qualified Plans Definition

National Association Of Tax Professionals Blog

Publication 590 B 2021 Distributions From Individual Retirement Arrangements Iras Internal Revenue Service

Cares Act Retirement Distributions Reporting Form 8915 F 2021 From 2020 Irs Form 8915 E Youtube

Publication 590 B 2021 Distributions From Individual Retirement Arrangements Iras Internal Revenue Service